Invest with impact.

Reduce your carbon footprint by replacing conventional investment methods in favor of granular portfolios of existing units.

Sustainable Granular portfolios at scale

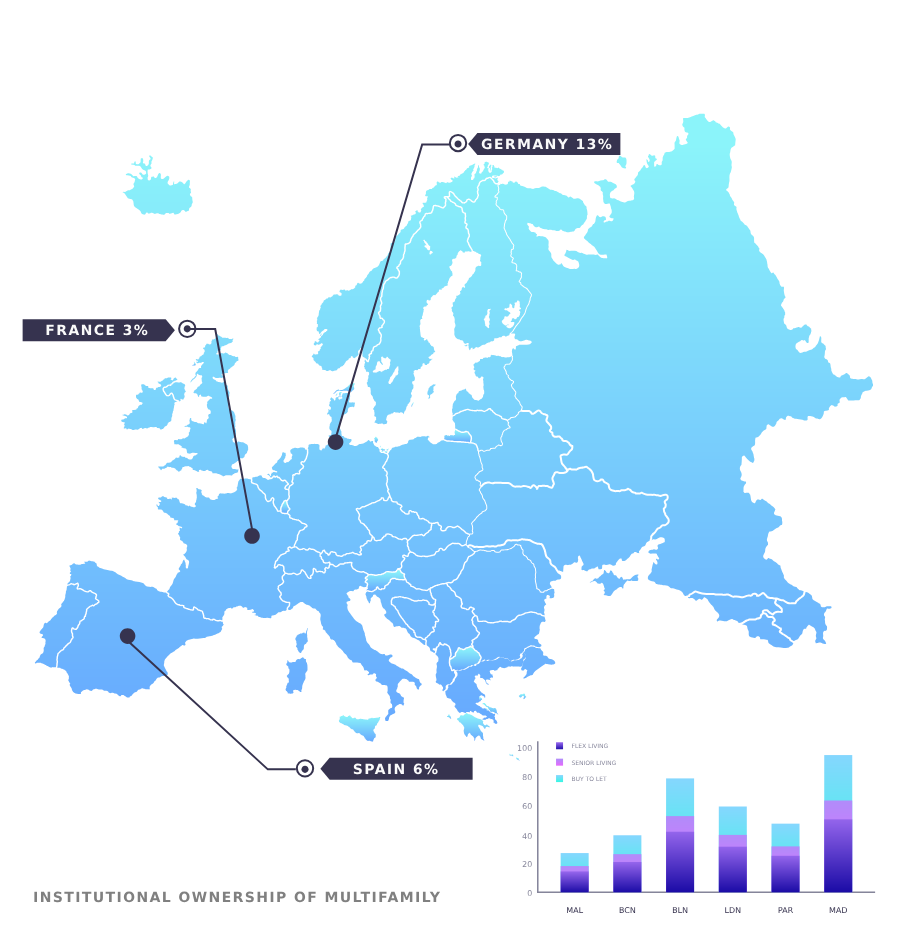

The vast majority of residential real estate, representing a trillion-dollar opportunity, remains inaccessible to institutional investors due to its fragmented nature. We’re changing that.

Granular residential isn’t just the largest segment of the market, it’s also outperforming other segments. We focus on existing units, minimizing construction waste and environmental impact while maximizing returns.

- Brown-to-green strategy

- Exit liquidity

- Risk-adjusted returns

- Cash flow stability. Resilence

- Diversification benefits

- Positive regulatory environmenrt

- Scalability due to the vast market

Investment as a Service

Everything you need to be successful: Powerful technology and a highly experienced, dedicated team

Transform your investment thesis into a market-ready action plan. Real-time data to evaluate the performance.

Tech-enabled sourcing to identify locations and assets with high growth potential. Simplified institutional-grade underwriting. ESG-Driven Renovations

Optimization of financial performance across portfolios with dedicated asset managers . Reporting built for institutional investors

Automated processes to improve management and reduce costs. Top-notch resident experiences through 24/7 maintenance support,.

AI-powered investing technology

Artificial Intelligence

Real-time Analytics

Automation

Nutual: Impact in Numbers

Properties analyzed

Average IRR

CO2 Reduction

Investment Opportunities

VALUE ADD

CORE+

SOCIAL IMPACT

Senior Living

Senior people demanding new housing solutions. Sale & Lease back.

- Gross yield: 10%

- Reg. LAU

- Rental period: 3-7y

- Main cities

VALUE ADD

SOCIAL IMPACT

Flex Living

Young people demanding flexibility and experiencies. Rent by the room.

- Gross yield: 14%

- Reg. Civil Code

- Rental period: 6-11m

- University cities

VALUE ADD

CORE+

Buy to Let

Offering tenants a flexible professional service adapted to their needs.

- Gross yield: 9%

- Reg. LAU

- Rental period: 5-7y

- Main cities

Tenant-Centric Approach

Nutual’s commitment goes beyond financial gains, prioritizing tenant satisfaction and well-being.

By renovating millions of vacant units, we significantly improve housing accessibility, providing high-quality living spaces and enhancing the overall tenant experience.

Carl Elefante

American Institute of Architects President

Sustainable Granular Portfolios

We’re not just unlocking access to a previously inaccessible asset type for institutional investors. We’re also contributing to the reduction of carbon footprint, aligning with the Circular Economy

Invest for a brighter future. Join us in making a positive impact.

Links

Nutual Investment Management · Copyright © 2024